Seller Representation

THERE IS NOTHING PERMANENT EXCEPT CHANGE” …Heraclitus

Our Process

Healthcare Transaction Group advises, arranges, and facilitates the sale of healthcare services facilities and companies. Our Pledge to clients is to:

ADVISE on optimal exit strategy, valuation, and marketing plan

FORMULATE a compelling presentation and investment thesis

PROMOTE opportunity to qualified buyers

NEGOTIATE the highest and best offer

NAVIGATE the deal to closing

EXECUTE a seamless transition of operations

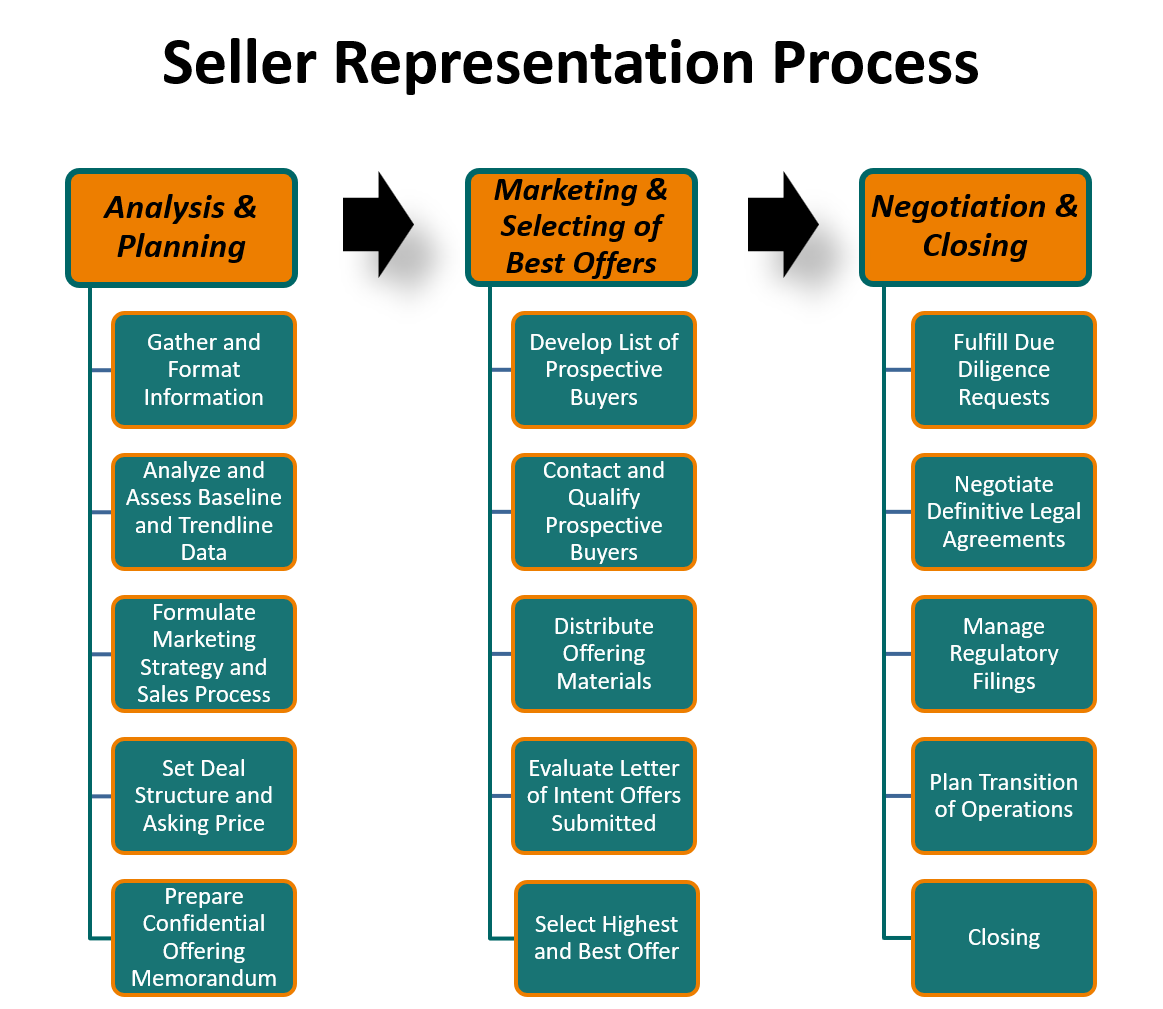

We run a Competitive Offering Process to create an “Efficient Marketplace” so that our clients can obtain the highest price and best deal. Owners who opt to sell via off-market sales are leaving money on the table. Our proven and tested Seller Representation Process comprises three phases:

1. Analysis, Offering Documents Preparation, & Planning

2. Marketing & Selecting of Offers

3. Negotiation & Closing

The sequence and steps of each phase are shown below.

We can handle single or multifacility sales, divestiture spinoffs, or multisite portfolio sales. For nonprofit clients, we provide an additional iteration or iterations, as may be appropriate, of evaluation and vetting of prospective buyers, to assure their alignment with mission values and objectives. Click here for a recent portfolio sale we completed.

Sellers hire Healthcare Transactions Group to conduct exclusive private sales, to find and qualify prospective buyers, to prepare and distribute a Confidential Offering Memorandum describing their business operations, results, and prospects, to negotiate the price and terms of the sale and to oversee the sales process discreetly.

We offer comprehensive Seller Representation services from planning, positioning, and pre-marketing a company, determining business’s value, identifying, soliciting and qualifying buyers in a bidding process, negotiating the deal, to the closing. While we bring buyers and sellers together, our trademark is to continuously facilitate, coordinate, and guide the transaction to closing.

Healthcare Transactions Group Sell-side M&A Activity Details

Pre-Marketing, Planning & Positioning the Company

- Identify Client’s objectives, values, and sale readiness

- Agree on value, timing, marketing plan, requirements and decision criteria

Collect & Analyze Data and Prepare Offering Documents

- Collect and Analyze the business’s historical and current data and trends

- Site visit

- Formulate investment thesis of upside value

- Prepare and Distribute comprehensive Confidential Offering Memorandum

- Populate online Data Room

Marketing & Solicitation

- Identify, Solicit, and Qualify Prospective Buyers

- Coordinate buyers’ Execution of Confidentiality Agreements

- Manage the Flow of Information & Communication with buyers

Bidding & Selecting

- Receive and Evaluate Bids

- Advise Client on selecting the highest and best offer

- Negotiate Offers to obtain best and highest proposal

- Select Winning Offer

Due Diligence

- Fulfill Bidder’s Due Diligence Requests

Negotiation of Legal Documents

- Negotiate deal points and legal documents

- Arrange & participate in teleconferences & meetings

Closing

- Oversee buyer’s Change of Ownership and other regulatory applications

- Coordinate transition of operations and onboarding process

- Close

Get in Touch

For more information on Seller Representation services, please call us at 410-902-2450 or contact us via our online contact form below.

Contact Us

866-MERGERS